Stock diversification calculator

Investing Calculators Tools - Fidelity Investing Calculators Tools Our investing tools can help you review your current strategy and maintain a portfolio with investments that fit your needs. The correlation coefficient is calculated by taking the covariance of the two assets divided by the product of the standard deviation of both assets.

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

For example you may not want one stock to make up more than 5 of your stock.

. Learn How to Build a Profitable Portfolio. Stock diversification to reduce risk The conventional wisdom is that you should diversify your stock holdings across pretty much all stock types. Ad Access Free Self-Paced Trading How-Tos.

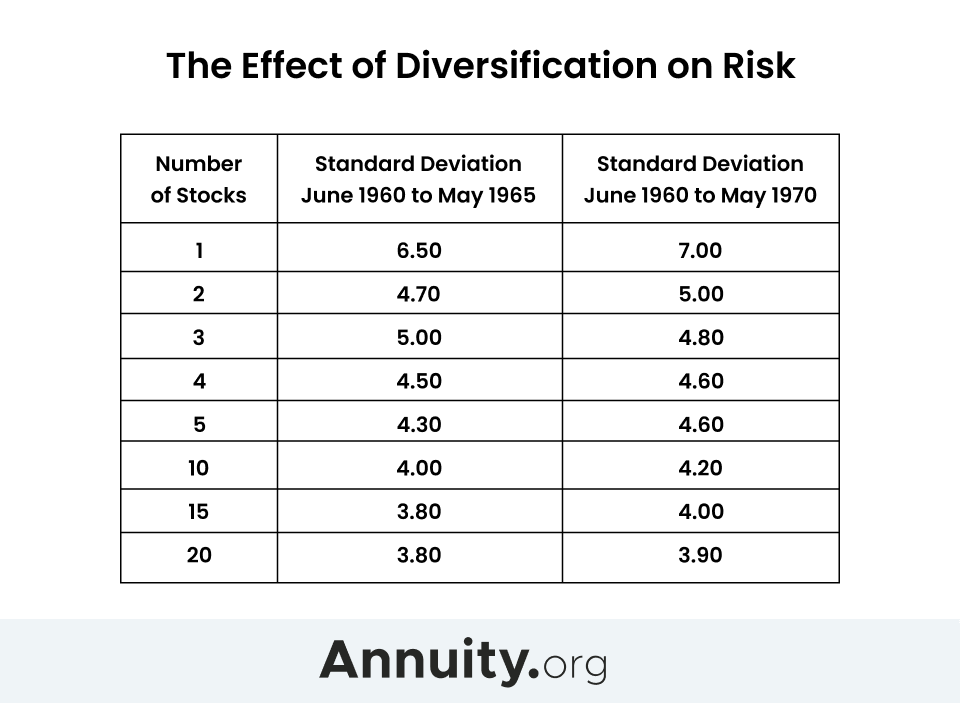

Investment Date Original Shares Original Value Current Shares Current Value Percent Return. Definition of Diversification Diversification is defined as a technique of allocating portfolio resources or capital to a mix of a wide variety of investments. A measure of how diversified a portfolio is.

1 meaning the stock movements of one asset. Learn How We Can Help. Investment analysis 2 Retirement planning 7 Education savings 7 Whether youre.

Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients. First add stock to your portfolio real or fictional by entering stock ticker symbol. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

Open an Account Today. August 2021 1 If you know the market you are aware of its dangerous fluctuations but luckily there. Additionally you must capture the entire industry diversification within each of the above markets.

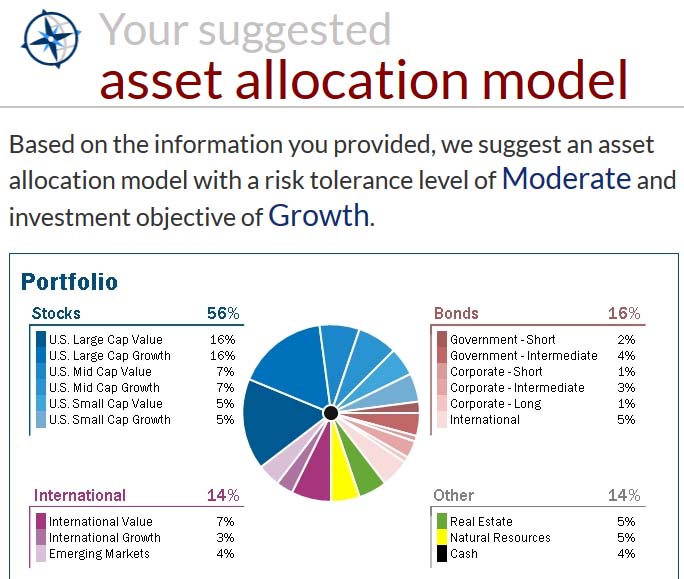

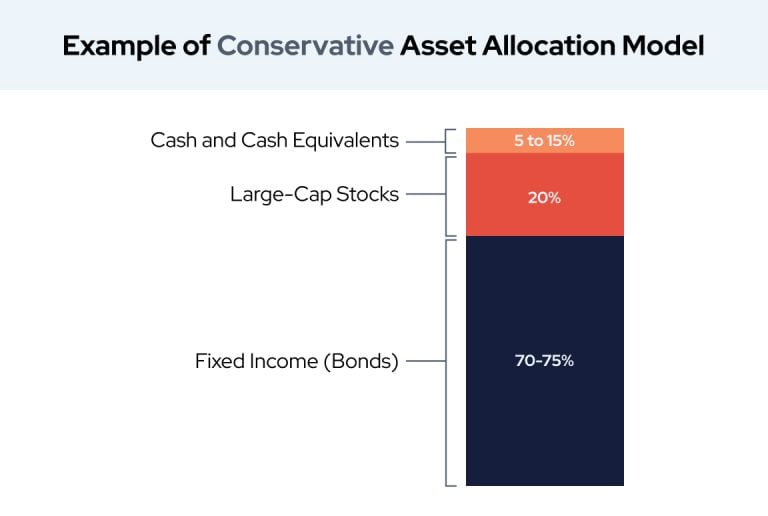

Northstar Risk uses the following formula to compute diversification scores. Ad Objective-Based Portfolio Construction is Key in Uncertain Times. The Asset Allocation Calculator is designed to help create a balanced portfolio of investments.

Over 90 percent of investment returns are determined by how investors allocate their assets versus security selection market timing and other factors Use this calculator to help. Second provide either the amount invested OR the number of shares you hold in each stock - then click Add. We can quantify diversification with a simple statistical term called Correlation.

This is based on the general observation. Correlation is simple it is a number ranging from -1 to 1. Just follow the 5 easy steps below.

Age ability to tolerate risk and several other factors are used to calculate a desirable mix of. Diversification Calculator Wealth Management Through Diversification We diversify investment portfolios in markets and industries across the world Try Our Diversifier Our Diversification. Our easy-to-use investment calculators and retirement tools can help you strengthen financial strategy.

Within your individual stock holdings beware of overconcentration in a single investment. It is a risk management. POTENTIAL IMPACT OF DIVERSIFIERS When allocating to diversifiers from equities as represented by the SP 500 TR index the tool shows that the resulting portfolios historically.

Our Resources Can Help You Decide Between Taxable Vs. We use a Monte Carlo simulation model to calculate the expected returns of 10000 portfolios for each risk profile. Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the.

The Stock Calculator is very simple to use. Correlation is essentially a. The diversification score ranges from 0.

An investor focused on growth but looking for greater diversification.

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Asset Allocation The Ultimate Guide For 2021

Asset Allocation The Ultimate Guide For 2021

Do It Yourself How To Invest Your Money

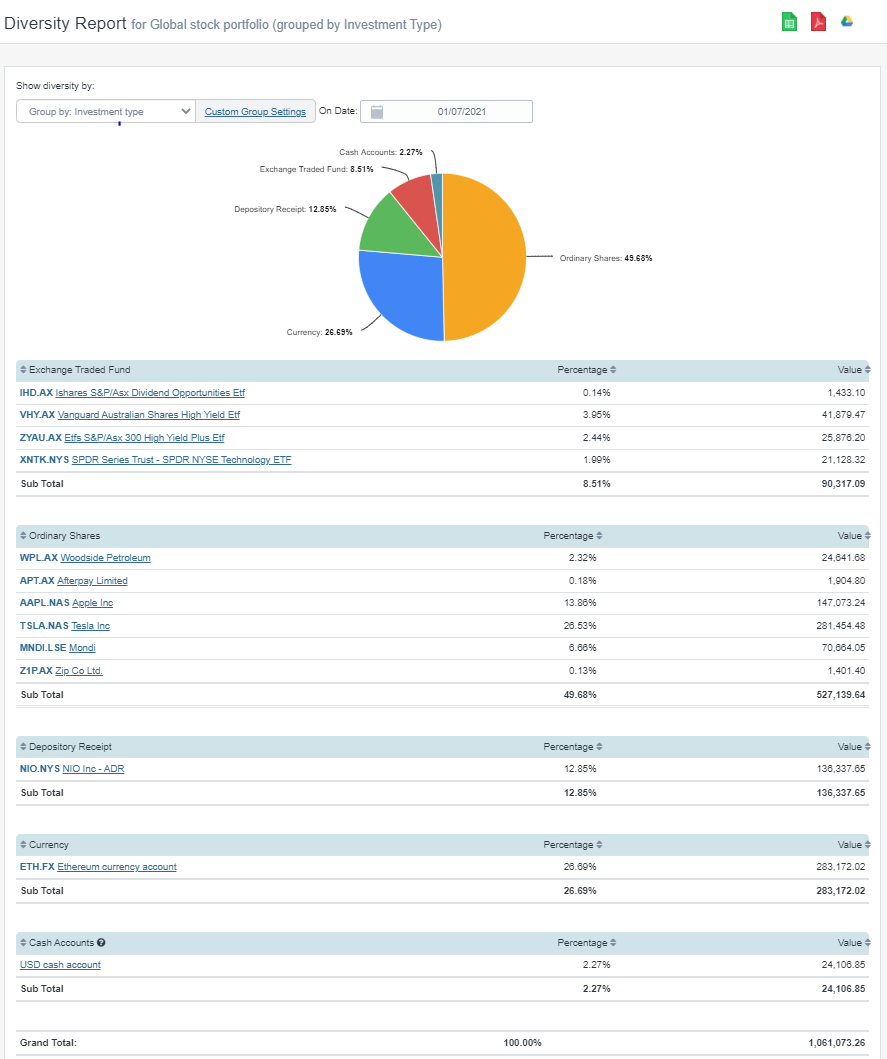

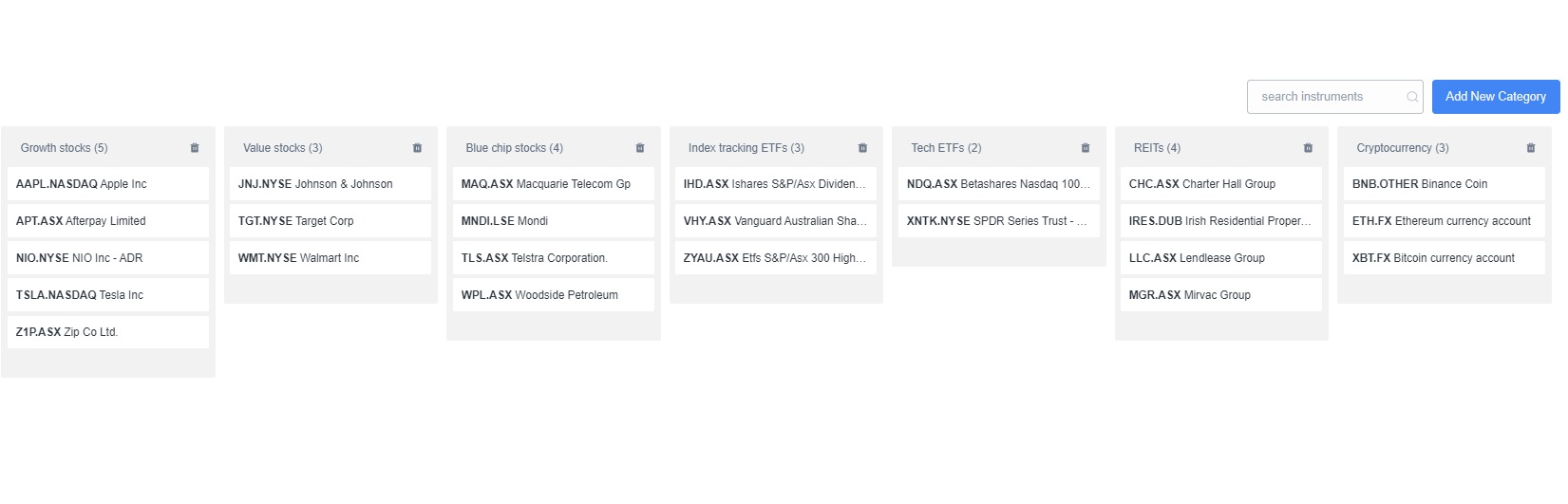

Calculate Your Investment Portfolio Diversification With Sharesight

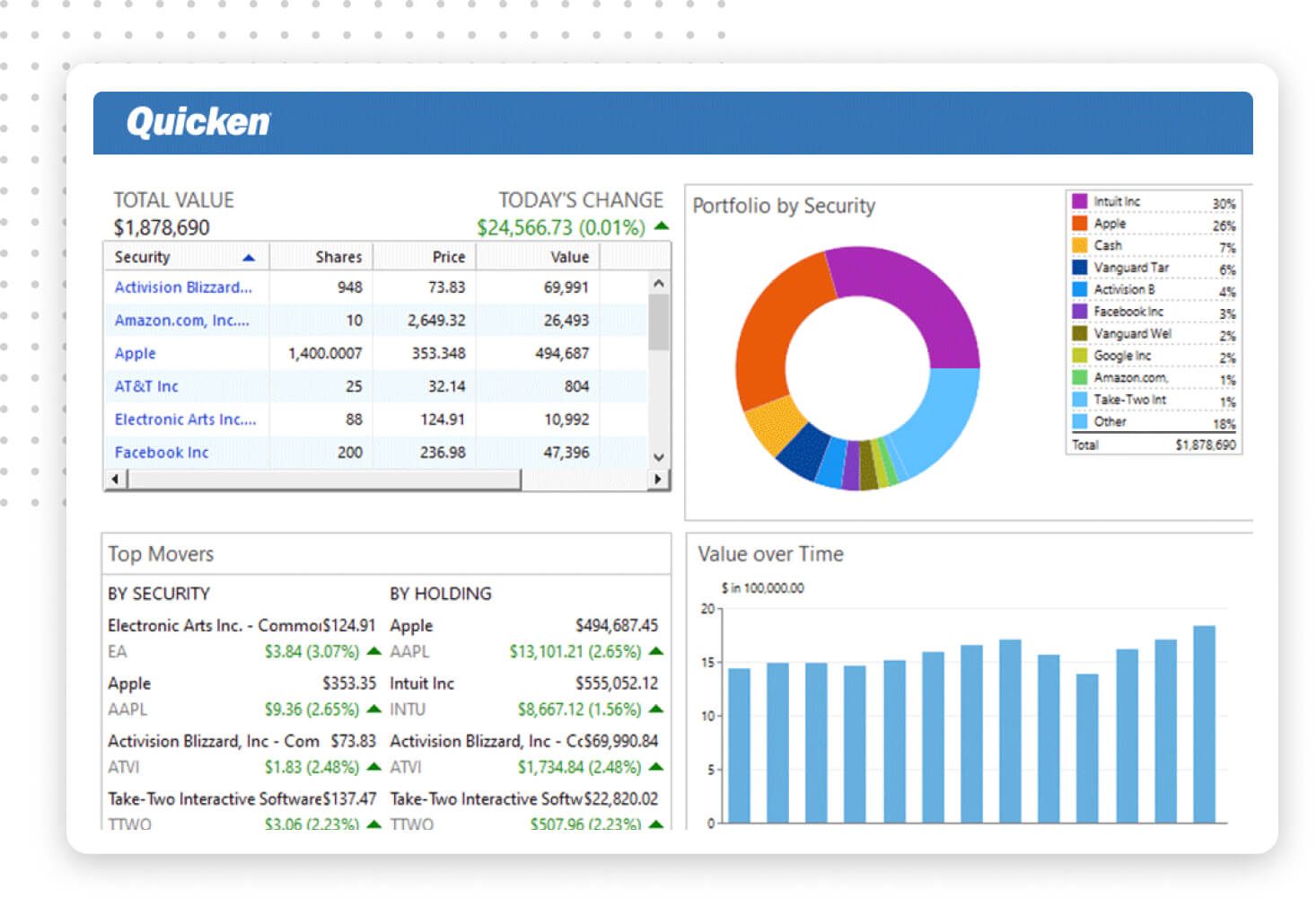

Quicken Investing Management Software Track Your Investments Today

The Proper Asset Allocation Of Stocks And Bonds By Age

Calculate Your Investment Portfolio Diversification With Sharesight

Investment Allocation And Diversification Calculator Kocaa

Calculate Your Investment Portfolio Diversification With Sharesight

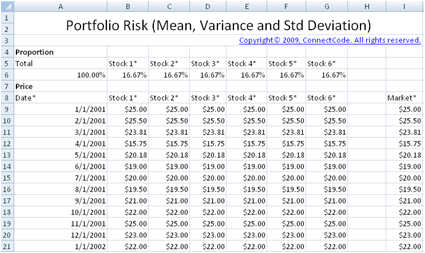

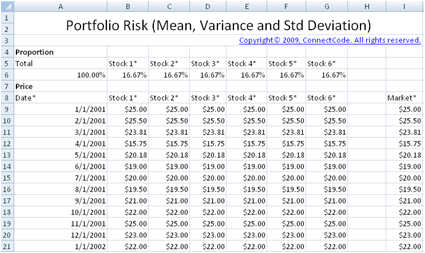

Free Modern Portfolio Risk Mean Variance Standard Deviation Covariance Beta And Correlation

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Diversification How To Build A Diversified Portfolio

Expected Return Of A Portfolio Formula Calculator Example Calculate Online

Asset Allocation Calculator Cnn Learning How To Invest Money

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

What Is Asset Allocation How Is It Important In Investing